ROVE MAGAZINE

$25 per magazine + shipping

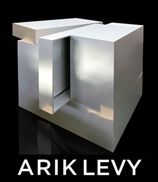

ART

BECOMES

ARCHITECTURE

BECOMES

ART

$25 per book + shippingWILLIAM POPE.L

20 hardcover

limited edition 800KENNY SCHACHTER ROVE

k@roveprojects.com

MARC FABER'S GLOOM BOOM & DOOM REPORT, Spring 2009

PRICE-LESS

A Banksy graffiti was recently sprayed with graffiti itself: the tagline was: Price-Less. And true it is as the graffiti genre has been swiftly and broadly hit by the onset of recession. Yet, even something priceless has a price less today than a year ago. We have seen the pace of globalization subside as people travel less, spend less and nest more. Such are ideal times to forge closer familial relations. We are experiencing a widespread realignment after a tectonic shift in world economic and social systems. And the massive aftershocks from this earthquake/tsunami have far from subsided. For the time being, we are becoming more provincial in outlook regardless of how far afield we hail from. In the condition of entropy things have a tendency to resort to a state of disorder and disarray, falling to bits and pieces like the peeling paint and decomposition of an old house—not unlike the international economy.

A major auction house recently sold an artwork for under £50,000—when the bidder evaporated as payment was due, they went as far as physically paying a visit to the residence to demand payment. I suppose it wasn’t Bill Ruprecht or Pinault doing the bidding in this instance, but in light of today’s stunning setbacks in every sector of the art and auction market, it well could have been. That’s proactive debt collection. From Sotheby’s dramatic stock slide to the 75% Tiffany & Co. is down (unless people have soured to marriage), everyone is desperately solicitous for business. Formerly aloof restaurant staff the world over are now mimicking the lyrics of the theme song from Friends: “where everyone knows your name”. It’s as though we are all acting without a script, working harder than ever and never making less. One possible upside is that there seem to be more people losing weight, maybe because its cheaper to be thin, and there is more time to spend (if not money) on fitness. On top of everything, it may appear too indulgent to be overweight these days.

Charles Dickens began A Tale of Two Cities with the line: “It was the best of times it was the worst of times”, a fitting description of the present predicament. People say how can anyone contemplate buying art in such historic trying times, but if you really like art, try trying not to. The urge to collect art is as primal as the facility to make it. From the first cave drawing came the first ravenous collector. Even in the recession-corrected times we are in, yes, things are less, but not all reassessments are created equal. Talk about an about face—but if you can’t contradict yourself, who can you? There were pockets of surging performances in the Spring 2009 auctions, and many records set in the process, though the trend is substantially lower volume and much the same with values. Overall, that collectors are still confident enough to continue to plow millions into pigment on canvas proves the notion that art really is an acknowledged asset class in the best sense of the term, despite the dire and relentless prognostications of the media. This only goes to prove we will get through this malaise with the market if not thriving as it once was, nevertheless intact. And a note to all the persistent naysayers, you can’t take away the sun (unless you are an avowed Gore-ian, global warm-ist).

A well known hedge funder expressed the opinion that art would come to have no value; funny how the art market continues to trudge along at quite an astonishing rate all things considered, while his fund, down 75% last year, will continue to drown deep under his high water mark. In art and design, signs of hope are beginning to abound. There was a recent strong Asian art sale, nearly all sold and more importantly, to all Chinese buyers (albeit more traditional works than speculative contemporary). A lucrative design sale where 45 year-old Australian designer Marc Newson’s dresser/bureau more than doubled the low estimate to sell at $517,000 was followed a few weeks later by $1,613,000 achieved for his Lockhead lounge, the highest price ever fetched for a living designer. Take note it’s an edition of 10 (Ten!) with 5 (Five!) “artist’s proofs”. It is now indisputable that design has reached parity with contemporary art as a recognized and established collecting category. The Yves St Laruent sale of the Eileen Gray $30m chair phenomenon was apparently no fluke: there’s a new benchmark for…the bench.

In the latest spate of Impressionist, Modern and Contemporary sales in New York there were nasty casualties such as an over estimated Picasso and Giacometti—no one and nothing is sacred from improbably high estimates. The art business today is characterized by the equation less art for less money equals more (solid results). Weak were recent high flyers like Jeff Koons and Damien Hirst, but there was still plenty of support even for such over-inflated artists by the likes of Larry Gagosian and other market preservers, and protectors. These players have vested interests too all-encompassing to permit collapse, or even the appearance of failure. In the past dealers colluded to keep prices artificially low to steal things on the cheap versus today where dealers and mega professional collectors frequently step in to provide a temporary fix to maintain and support the illusion of health and wealth in the system. Whether this propping will last is anyone’s guess.

Modern and Impressionism and Contemporary sales are two wildly different animals when it comes to market performance but hand it to Christies where the Contemporary results nearly mirrored the levels of Mod and Impressionist. When collectors are now flocking in droves to safer, historically established works, that’s as bullish an indicator as can be for recent art in particular and the market in general. As an addendum to the story of wealth barometers in the recessionary economy, a classic Ferrari just made over $12m, a record for a public sale, which was considered by the media a disappointment (the house was hoping for $15m it was stated). It’s enough to make tears well up when you consider the shortfall in expectations—could things really be so dismal that a car can’t achieve the price of a plane? I remember the days when a nice car could be had for a cool million.

Another Tale of Two Cities was the latest tale in the ongoing war of Sotheby’s vs. Christies. Sotheby’s held their May sales for Impressionist/Modern and Contemporary on consecutive Mondays while Christies followed on successive Tuesdays. This scheduling bifurcation of sales dates ended in very divergent results. In both Sotheby’s Monday auctions the buyers seemed to be only interested in testing the waters, looking for assurances that there was to be no Chicken Little moment, while such hesitations nearly caused the sky to fall on the market. The anemic and tepid bidding was disastrous, only to be followed on both occasions by firm and decidedly successful performances at Christies. That both early sales by Sotheby’s failed the first day of the week was no coincidence. In the bigger picture, what a difference a year makes for Contemporary as both houses are down in volume about 85% from a year ago.

I’d like to share a poem I wrote on the way to the bank to deposit the proceeds from the sale of two watches (hard times demand tough actions):

A Bad Date

A bad date it was for Sotheby’s!

A lucky date, a hot date

A date with fate

Better late

For Christies

Kenny Schachter