ROVE MAGAZINE

$25 per magazine + shipping

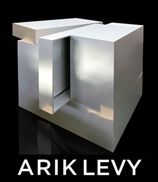

ART

BECOMES

ARCHITECTURE

BECOMES

ART

$25 per book + shippingWILLIAM POPE.L

20 hardcover

limited edition 800KENNY SCHACHTER ROVE

k@roveprojects.com

ART INVESTOR MAGAZINE, Fall 2005

FRIEZE DISEASE, OR THE BURSTING OF THE BALLOON

When will the reassessment come, the day of reckoning, for a time when demand not only influences art but instigates it, determines the form? Isn’t the repetitive nature of some art production in endless series just another name for creating more of the same stuff? Does it stop becoming “art” as conventionally conceived to this point? Will there be accountability from a time when a de Kooning pencil drawing is worth less than a Hirst spot print in an edition of 1000? The Chapman brothers’ chuckle that their embellishments to Goya prints retail for more than the originals, as if that’s something to boast about rather than lament. Welcome to the world of contemporary art. Maybe the Frieze disease will end when rising interest rates throw a wrench into the runway inflation of contemporary art prices. That’s when the fairs will loose their stranglehold on who does and does not get to participate in the international art dealing game. Cliques of self-congratulatory dealers, patting themselves on the back at denying participation of those not deemed cool enough or worthy enough to play. A cesspool of intertwined worms under a rock.

Don’t get me wrong, I too am admittedly complicit in the enterprise, yet another opportunistic virus, taking advantage of the run up in prices of the select artists (like everyone else) coveted by the present market.Sign of the times: In a recent fair I observed a private dealer friend, invited with room and board to one fair after another like a gambler to Atlantic City, buy down one isle and sell down the next, time and again. In the same fair! Talk about inefficiencies in markets and the vagueness of what passes for hard information in the art world.

Ceci n’est pas une pipe. I learned firsthand art-world-style that sometimes a pipe really isn’t a pipe purchasing a contemporary photograph by a white-hot artist, signed and dated, from a “collector” at last year’s Armory Fair in New York. This occurred when I made a subsequent sale of the work and the purchaser called the well-known, old school New York Chelsea gallerist who then shot down the sale, denying the authenticity of the print. Her reasoning was that it was not what it appeared to be on its face, from a desirable series by the artist, and was worth substantially less than the agreed upon sales price. These comments were communicated to my client in the face of emails from the very gallery to a prior purchaser to the contrary. This happened with 3 further attempts to sell the work and I was only able to attain a proper certificate from the gallery after hiring a lawyer to draw up a complaint for defamation and interference of a contract. Does this happen anywhere other than in the art world?

I have no issues with the fact more people are looking at, making and buying art than at any other time prior in history. This is a good, wonderful, healthy phenomenon and the fairs in the best of worlds act as non-threatening, welcoming environments in which to experience and appreciate art. Perhaps the fairs are even contributing to the ultimate obsolescence of galleries themselves. However, when connoisseurship and aesthetics are sacrificed in the name of fashion and speculation, you end up with a dangerous minefield. Collectors flipping art without sometimes even a rudimentary viewing should be a bright red flag that danger lurks on horizon.

Kenny Schachter